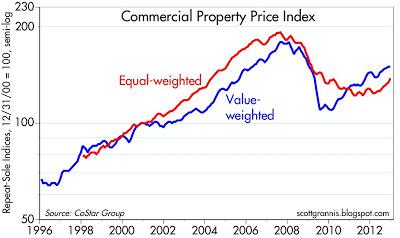

The recovery in commercial real estate is now almost four years old. As the first chart shows, commercial property prices are up decisively in recent years. As reported by CoStar, its Value Weighted Index was the first to turn up due to strength in the high-end sector of property market. But now the equal weighted index is starting to catch up, a sign that the recovery is broadening.

The second chart shows the price action for Vanguard's REIT fund, whose price has risen 215% from its March 2009 low. On a total return basis, this fund has trounced the S&P 500, gaining 287% vs. 142% since the March 2009 lows.

Thanks to panic-induced selling in late 2008 and early 2009, commercial real estate and related prices reached incredibly depressed lows. This represented one of the buying opportunities of a lifetime. If the economy merely avoids another recession, commercial real estate is likely to continue to deliver attractive returns relative to the almost-zero yield on cash.

Disclosure: I am long VNQ at the time of this writing.

ashley judd Alois Bell Donna Savattere deer antler spray Jason London coachella rick ross

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.